Been There, Done That: What Living Inside Acquisitions Teaches You About Better Due Diligence

Why experience inside acquisitions leads to better questions, clearer interpretation, and more informed risk and opportunity assessment.

Mergers and acquisitions are often discussed in clean, analytical terms. Valuation models, synergy assumptions, integration plans, and timelines dominate the conversation. On paper, the process appears structured and logical.

Inside the business, the experience is far more complex.

For leaders and employees living through an acquisition, the transaction represents uncertainty, shifting authority, changing expectations, and real concern about relevance, workload, and future direction. Longstanding ways of working are questioned. Relationships are disrupted. Decisions that once felt clear now require approval from unfamiliar stakeholders.

Acquisitions are often planned in theory and lived in reality. The gap between the two is where value is either protected or lost.

At Hoagland Management and Consulting, our approach to due diligence and post-merger integration is shaped by something that cannot be learned from frameworks alone. Our team has lived inside acquisitions from multiple vantage points. Our team has held senior operating and functional leadership roles inside companies before, during, and after acquisitions. We have operated within acquiring organizations. We have served as interim leaders responsible for stabilizing and integrating companies after close. We have also advised private equity firms before and after transactions.

That collective experience across aerospace and defense manufacturers, high-technology companies, industrial and telecom businesses, and lower-middle-market portfolio companies informs how we evaluate risk, readiness, and value creation. It also shapes how we distinguish between what genuinely works in transactions and what quietly undermines them.

Why Experience Changes the Questions That Get Asked

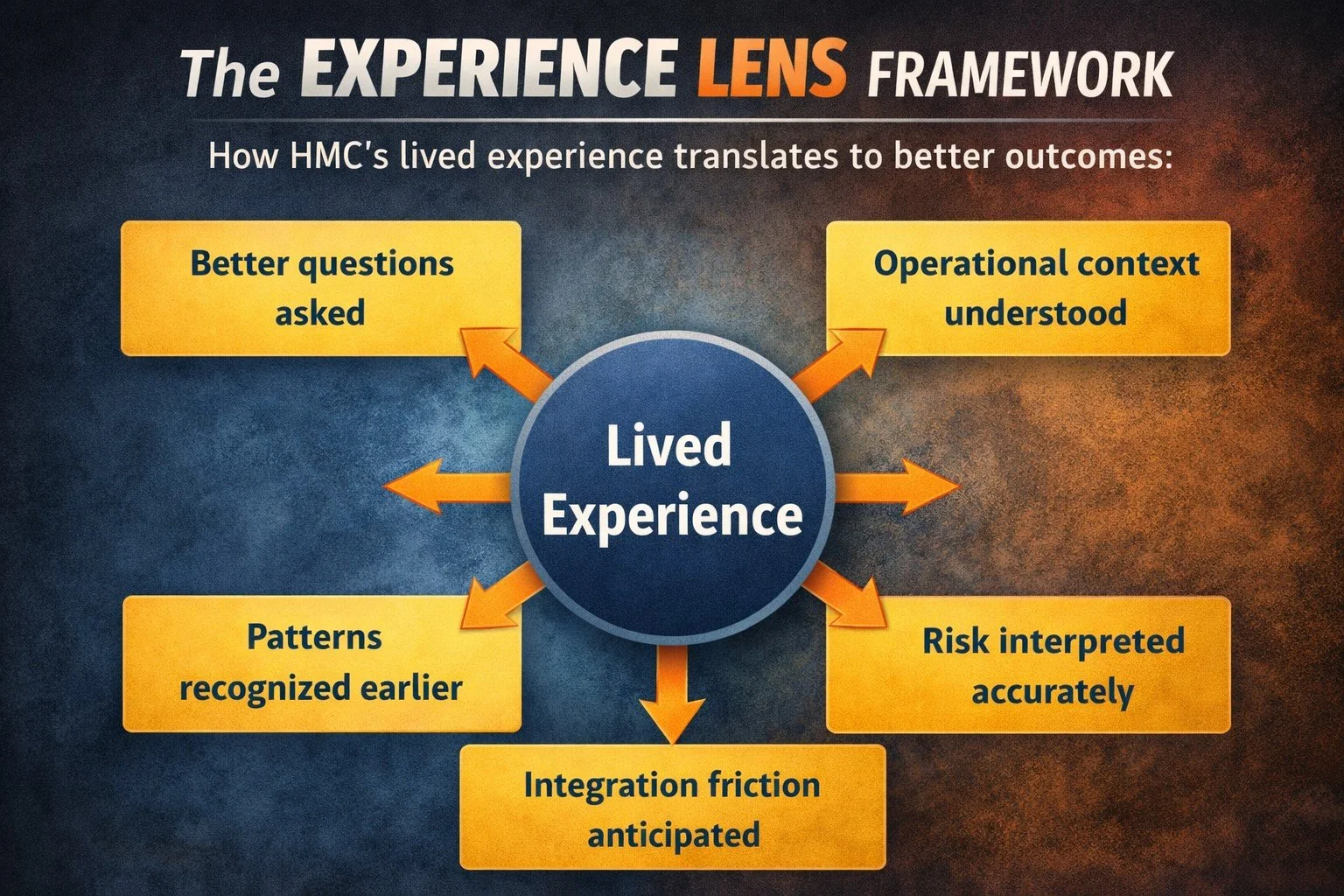

One of the most tangible advantages of having lived inside acquisitions is not just knowing what to look for, but knowing how to ask the right questions early and how to interpret what comes back.

In our experience, effective due diligence is rarely about asking more questions. It is about asking better questions, then listening carefully to the answers, understanding what is said and what is not said, and knowing when to probe deeper.

Teams that have not lived through integrations often rely heavily on checklists, data requests, and management presentations. Those tools have value, but they tend to surface what organizations are prepared to show. Leaders who have been through acquisitions recognize patterns more quickly. They hear when answers are overly optimistic, when assumptions are untested, or when confidence is masking uncertainty.

Because HMC’s team has operated inside acquired businesses and within acquiring organizations, we are able to interpret responses through an operational lens. When a leader describes how programs are managed, how customers are supported, or how suppliers are qualified, we understand what that actually means in practice. We recognize when processes are robust versus informal, when accountability is clear versus assumed, and when risks are being managed versus deferred.

That understanding allows us to ask the next level of questions. If projected growth depends on new program wins, we probe the realism of win probabilities, margin assumptions, and execution readiness. If synergies depend on outsourcing or consolidation, we examine supply chain resilience, customer sensitivity, and regulatory or contractual constraints. If leadership depth is cited as a strength, we explore decision authority, succession planning, and how the organization performs under stress.

This iterative questioning process leads to a far more informed assessment of both risk and opportunity. It helps identify where value can realistically be created, where integration friction is likely to emerge, and where early intervention can prevent issues from becoming costly surprises after close.

In short, experience enables discernment. It allows diligence to move beyond validation and toward true understanding.

Lived experience changes how diligence is performed. It enables better questions, clearer interpretation, and earlier recognition of both risk and opportunity.

Why Well-Structured Deals Still Struggle

Most diligence processes do a reasonable job assessing financial performance, backlog, customer concentration, and market positioning. These elements matter. But in our experience, the risks that damage value most often do not show up in spreadsheets or data rooms.

They emerge in areas such as unclear decision authority after close, misaligned leadership expectations, cultural norms that conflict with the new operating model, and teams that are already stretched being asked to absorb integration work while still delivering for customers.

Many transactions struggle not because the strategy was flawed, but because the human and organizational realities were underestimated. Integration friction is not an exception. It is a predictable outcome when leadership alignment, accountability, and capacity are not addressed early.

What We Have Seen Go Right and Why It Worked

Across a wide range of acquisitions, several consistent success patterns emerge when transactions perform well.

Disciplined execution increases enterprise value.

In one aerospace-focused business, leaders applied strong program management practices well before a sale. The focus was not just on revenue growth, but on cash flow, contract risk, and execution discipline. Cross-functional teams were created to stabilize underperforming programs. Customer contracts were renegotiated to limit financial exposure. Operational risks that could disrupt production were actively managed.

The result was a business that became significantly more valuable in a relatively short period of time. Strong execution did more than improve near-term performance. It created credibility with buyers and expanded strategic options for ownership.

Sales structure matters more than momentum.

In a technology-enabled industrial business experiencing inconsistent revenue, leadership changes and disciplined sales processes transformed performance. Territory ownership was clarified. Account planning became standard practice. The right people were placed in the right roles, and accountability was enforced. Underperforming leadership was addressed directly.

Revenue growth followed quickly, driven not by market conditions, but by structure replacing ambiguity.

Dedicated integration leadership reduces friction.

In complex manufacturing environments, relying on existing leaders to manage integration often fails. These leaders already carry full operational responsibility. Successful integrations appointed seasoned integration leaders with clear authority, formal risk management processes, and structured communication rhythms.

Regular functional reviews and stakeholder updates created transparency, alignment, and trust while allowing operating leaders to remain focused on customer delivery.

Successful integrations are built where strategy, leadership, and execution intentionally overlap rather than collide.

Thorough diligence clarifies reality.

In one private equity diligence effort, a comprehensive assessment examined technology maturity, operational processes, leadership capability, market positioning, and risk exposure. The goal was not simply to validate the transaction, but to identify what would need to change after close.

Leadership recommendations were made early, allowing the acquiring firm to act deliberately rather than react under pressure.

Clear operating plans anchor integration.

Businesses preparing for sale or newly acquired benefit from alignment. Multi-day operating planning sessions that define priorities across all functions create shared ownership. Clear metrics across operations, finance, supply chain, quality, and sales ensure that integration efforts remain focused and measurable rather than diffuse.

Leadership Style and Culture Matter More Than Expected

Leadership style and cultural compatibility often determine whether otherwise sound integration decisions succeed or fail.

In one lower-middle-market manufacturing acquisition, an interim executive was placed alongside a retiring owner to support transition and alignment. Structurally, the approach made sense. In practice, leadership style proved decisive. A highly directive approach that may be effective in large corporate environments created conflict, eroded trust, and damaged morale in a smaller, relationship-driven organization.

Culture is not about slogans or values statements. It is about how decisions are made, how accountability is enforced, and how people respond under pressure. When leadership behavior conflicts with organizational norms, integration friction increases and performance suffers.

Where Transactions Commonly Go Wrong

Understanding what fails is just as important as understanding what succeeds.

Brand equity can be damaged quickly.

In one acquisition, a highly respected product brand was eliminated in favor of the parent company’s identity, despite the parent having limited recognition in that market. Customer confidence eroded almost immediately.

Overly optimistic assumptions distort outcomes.

We have seen sellers present aggressive projections around future programs, margins, and backlog that exceeded industry norms or regulatory realities. Without disciplined diligence, buyers inherit risk that only becomes visible after close.

Imposed processes can demoralize teams.

Forcing acquiring-company procedures onto a well-functioning organization can backfire. In several cases, the acquired company’s processes were actually more efficient and better aligned to customer needs. Mandated change slowed execution and damaged morale.

Misaligned reporting structures create dysfunction.

When employees report operationally to one leader and administratively to another, especially when one is remote and unfamiliar with the business, priorities become confused. Workloads increase, responsiveness declines, and teams burn out.

People risk is underestimated.

Failing to identify critical talent and plan for retention creates fragility. Losing a key engineer, program manager, or supplier owner can cascade into operational disruption. Excessive loyalty to underperforming leaders can be just as damaging.

Supply chain risk is often overlooked.

Supplier contracts, sole-source dependencies, succession planning, and financial health frequently receive insufficient attention. Weak supplier risk management has derailed otherwise sound integrations.

Customers react to ownership change.

Customers do not automatically follow acquisitions. Pricing, delivery performance, quality, warranty terms, and cultural alignment influence whether customers remain loyal or begin exploring alternatives.

Teams are overloaded during integration.

Asking the same people to run the business and execute integration without relief creates resentment, fatigue, and mistakes. Integration becomes something done to the organization rather than with it.

Why Organizational Readiness Determines Outcomes

Many integrations struggle not because of poor strategy, but because organizational readiness was misjudged.

Decision velocity slows. Accountability fractures. Leaders with overlapping authority create confusion. Teams comply outwardly while resisting privately. Founder-led organizations struggle to adapt to new governance and reporting expectations.

These dynamics rarely appear in diligence summaries. Yet they determine whether integration creates value or becomes an exercise in damage control.

This is why organizational assessment before or immediately after close is critical. Understanding where authority will truly sit, who will adapt, and where friction will emerge allows leadership to act early, while momentum still exists.

How These Experiences Shape HMC’s Approach

Because HMC’s team has lived these challenges directly, we approach due diligence and post-merger integration differently.

Our focus extends beyond financials and operational metrics to include leadership alignment, decision rights, cultural compatibility, customer and supply chain risk, and the actual capacity of teams to absorb change.

We treat integration as an operating discipline, not a side activity. Clear ownership, structured communication, and respect for what already works are essential.

Most importantly, we recognize that acquisitions are human events. Organizations do not integrate themselves. People do.

Closing Perspective

The most effective acquirers accept a simple truth. Friction is inevitable. Value erosion is not.

When leadership plans for the lived reality of integration rather than an idealized version of it, transactions are far more likely to deliver on their promise. Having lived inside acquisitions from multiple perspectives, we have learned that value is protected not by asking more questions, but by asking the right questions early, understanding the answers in context, and knowing when and how to go deeper before assumptions harden into risk.

About Hoagland Management and Consulting

Hoagland Management and Consulting works with companies, boards, and investors that are considering or navigating acquisitions, as well as organizations managing complex transitions following a transaction. Our team brings firsthand experience from inside acquisitions as operators, interim leaders, and advisors, with deep backgrounds across aerospace, defense, industrial, and engineered product businesses.

We partner closely with leadership teams to surface risk early, align organizations and decision-making, and translate strategy into disciplined execution that protects value and supports long-term performance.

Considering an acquisition or evaluating one already in motion?

Experience matters. Learn how Hoagland Management and Consulting helps organizations ask better questions early and make more informed decisions at www.hoaglandmgt.com.

About the Author

Michael Hoagland is the Founder and Managing Director of Hoagland Management and Consulting. He is a seasoned executive and advisor with deep experience in aerospace, defense, industrial, and engineered product businesses. Over the course of his career, Michael has held senior operating and functional leadership roles within companies before, during, and after acquisitions, including responsibility for program management, operations, strategy, and post-transaction execution. His work spans private equity–owned businesses, strategic acquirers, and complex manufacturing organizations, where he focuses on helping leadership teams navigate change, surface risk early, and translate strategy into disciplined execution.

Read Michael's full bio to learn more about his background and expertise.

Michael Hoagland - Hoagland Management & Consulting LLC

© 2026 Hoagland Management & Consulting LLC. All rights reserved.